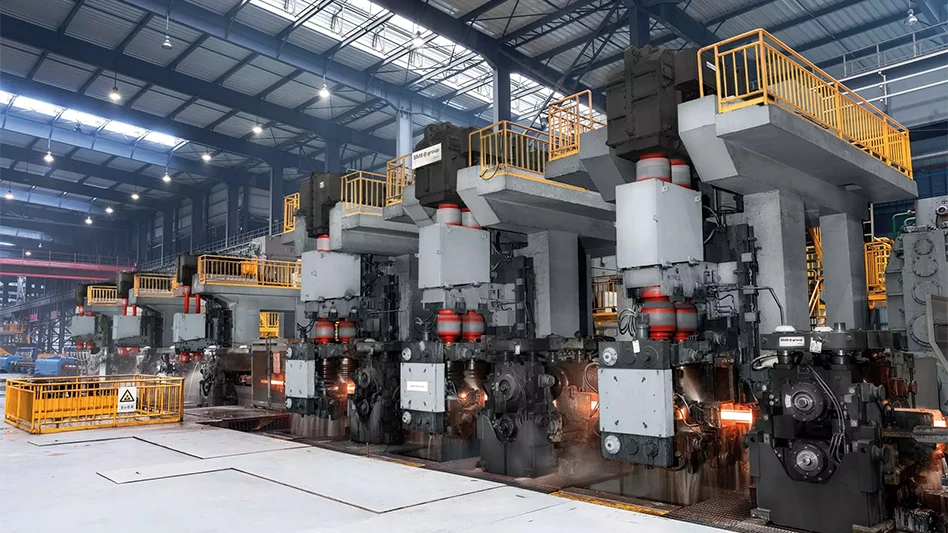

Photo courtesy of SMS Group

Osceola, Arkansas-based Hybar has raised $700 million of debt and equity financing to build, start up and operate an electric arc furnace (EAF) steel rebar mill in that city.

Hybar, a newly formed company led by former Big River Steel executive and current Hybar CEO Dave Stickler, says its planned rebar mill will be technologically advanced and will be fed by “environmentally sustainable” scrap metal.

In February, Germany-based steel mill technology provider SMS Group announced it would be supplying Hybar (then known as Highbar LLC) with melt shop and casting technology for a 630,000 tons per year rebar mill. The initial order also included options for SMS to supply two additional Hybar minimills.

Stickler and his colleague, Chief Financial Offiver Ari Levy, say they have a long and successful track record of investing in, building and operating scrap-fed steel mills in North America and elsewhere in the world.

The equity portion of Hybar’s financing was led by TPG Rise Climate, “the dedicated climate investing strategy of Texas-based Tarrant Capital IP (TPG)’s global impact investing platform TPG Rise.” Also involved is Global Principal Partners, an investment entity used by Hybar’s senior management team

“It says a lot about the Hybar project given that we have the same high-profile financial providers that have invested alongside Dave and me on prior projects, including the highly successful Big River Steel flat-rolled steel mill, which is located two miles away from the Hybar site," Levy says.

Also announcing itself as a Hybar backer is Kansas-based Koch Minerals & Trading, whose subsidiary Koch Metallics says it will provide metal procurement services to Hybar and risk management services to its customers.

Of the $700 million raised, $470 million will be spent to build the rebar mill, TPG says in an August news release. The remainder of the financing will be used to start up and operate the mill and pay some debt service costs during construction.

The mill is expected to take 22 months to construct on a 1,300-acre greenfield site with direct access to barge, rail and truck transportation options, according to TPG.

The mill’s planned output will be “high-yielding rebar that will primarily be used in large infrastructure projects, including projects supported by the Infrastructure Investment and Jobs Act and the Inflation Reduction Act."

In addition to SMS Group, another supplier to the mill is London-based Primetals Technologies, with both companies providing technology Hybar says is designed to significantly reduce the amount of energy needed to produce rebar, especially when compared to other rebar mills in North America.

Hybar says the technology it will use also will greatly limit greenhouse gas (GHG) emissions. “Hybar’s ability to drastically reduce energy use while simultaneously limiting GHG emissions were key drivers leading to Hybar being the first steel company globally to be certified to issue climate bonds,” the firm says.

“The Climate Bond certification aligns perfectly with Hybar’s plan to offer our customers competitively priced rebar that is also the greenest rebar in the market,” Stickler says.

“We look forward to building on the deep relationship and successful partnership we’ve had with Dave and Ari over many years,” says Mike Stone, a partner at TPG. “Our investment in Hybar not only reflects the trust we have in this talented management team but our thematic focus on sustainable materials broadly, and on green steel production specifically. The global steel industry accounts for 7 to 9 percent of global CO2 emissions today, which creates a massive opportunity for Hybar to drive decarbonization at scale.”

Hybar’s mill will be directly connected to an adjacent solar energy facility, designed to allow the company during certain periods of the day to use electricity generated from 100 percent renewable sources.

Hybar plans to produce 630,000 tons of rebar annually with approximately 154 employees (4,090 tons of rebar production per year per employee). The 154-employee figure includes all employees, not just operating employees, meaning Hybar expects “to be the most labor efficient steel rebar producer in the world.”

Goldman Sachs & Co. is serving as lead underwriter for Hybar’s climate bond offering with Atlanta-based Truist Securities and Arkansas-based Crews & Associates acting as co-managers. Cleveland-based BakerHostetler and Los Angeles-based Latham & Watkins have served as counsel to Hybar, with Little Rock, Arkansas-based Mitchell Williams serving as local counsel.

Latest from Construction & Demolition Recycling

- Copper tariff talk causes price spike

- Sims’ late 2024 earnings decline from 1 year earlier

- Apple to build manufacturing facility in Texas

- Atlas and Mantsinen brands add Louisiana dealership

- C&D World session preview: Leadership insights on industry trends and challenges

- Mazza Recycling adds to transfer station operations

- Michigan awards $5.6M in recycling, waste reduction grants

- Pittsburgh area mall headed for demolition