According to recent data from the Civil Quarterly (TCQ), a new publication from Dodge Data & Analytics, contractors in the heavy civil construction sector are facing supply chain issues and other challenges in keeping job sites going.

The report, which provides a snapshot of the current business health of contractors operating in this dynamic environment, features research on how technology is transforming civil job sites and on the prevalence of important safety practices. Ninety-nine contractors responded to the survey conducted online from mid-April to mid-May.

Some key business health findings suggest that heavy civil contractors are generally optimistic about business conditions, despite impacts of COVID-19:

- Over half (56 percent) have a high level of confidence about the market's ability to provide new business opportunities for the next 12 months, increasing to 63 percent for a two-year outlook.

- Contractors appear to be satisfied with the level of backlog they have right now, since the ratio of the average months of backlog reported and of the average ideal backlog is 92. This contrasts with commercial contractors who in a recent Dodge study had a ratio of average current to ideal backlog of 73.

However, the research also uncovered two areas of concern for these contractors: changes in profit margin and the availability of skilled workers.

- 38 percent expect a decrease in their profit margins in the next year, and only 29 percent expect an increase.

- 60 percent have a high level of difficulty finding skilled workers currently, and 53 percent expect the cost of skilled workers to increase in the next six months. Almost half (43 percent) of those expecting the skilled labor cost increase believe that they will be challenged to meet budget requirements on their projects due to it.

These findings show an industry adjusting well to the impacts of the global pandemic, yet cautious about their bottom line. The metrics will be tracked in future surveys and changes reported in upcoming issues of TCQ, according to a release.

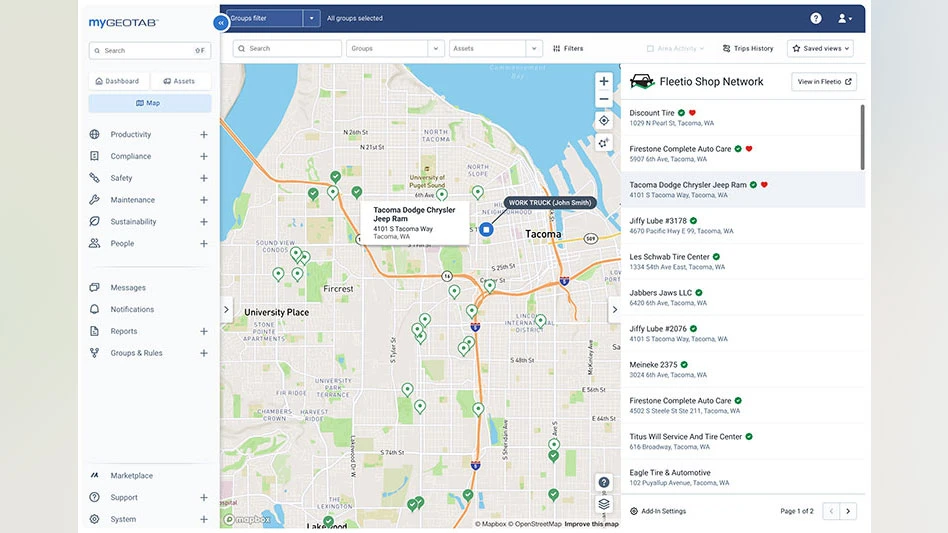

In addition, the technology study reveals widespread adoption of many advanced tools and digital processes in the heavy civil sector. The top benefits that contractors expect from adopting new technologies onsite are increased productivity, better ability to manage the project budget and improved safety performance.

When asked about their biggest barriers to using new technologies onsite, the highest percentage (56 percent) point to the cost of technology, and workforce challenges are also obstacles, with 47 percent concerned about workforce adoption of technology and 40 percent lacking the skilled resources to manage technology.

Latest from Construction & Demolition Recycling

- Radius to be acquired by Toyota subsidiary

- Pacific Steel selects Danieli as EAF equipment supplier

- Viably, Turmec partner on Ohio installation

- EPA plans to revisit numerous environmental, climate regulations

- Connecticut recycling facility looking to accept C&D faces local pushback

- Fornnax wins Green Innovation of the Year award

- ABC: Construction backlog inches lower, staffing levels expected to grow

- Former detention center in Cleveland set for demolition