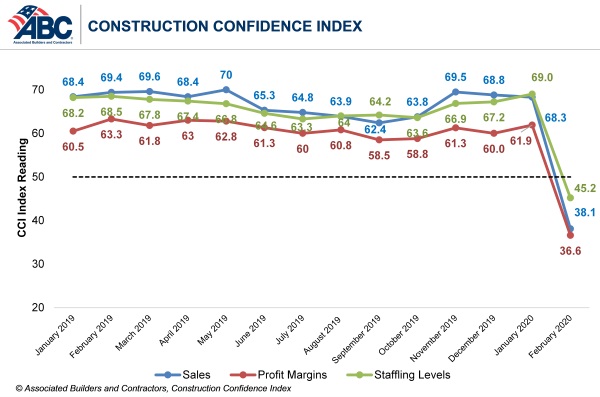

Confidence among U.S. construction industry leaders plummeted in response to the economic fallout associated with COVID-19, according to the Associated Builders and Contractors Construction Confidence Index (CCI) released April 23. Data regarding sales, profit margins and staffing level expectations fell below the threshold of 50 for the first time in the history of the series, signaling expected contraction along all three dimensions. The CCI is a diffusion index where readings above 50 indicate growth, while readings below 50 are unfavorable. This survey was conducted March 20-31.

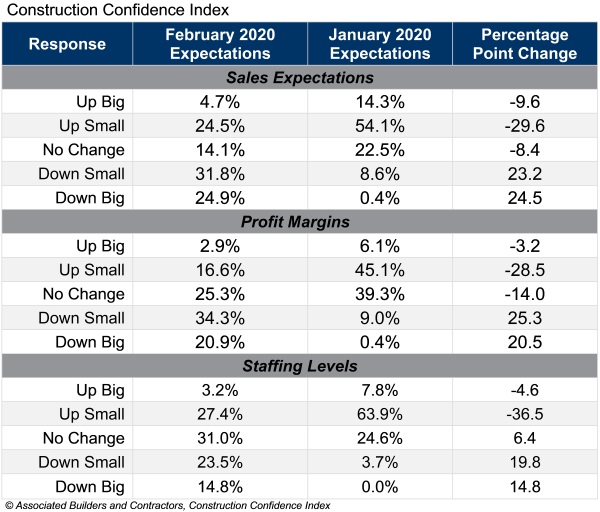

As of February, fewer than 30 percent of contractors expected their sales to increase over the next six months, while less than 20 percent of contractors expected their profit margins to increase. More than one in five contractors expects a significant decrease in profit margins, while one in four expects a significant decline in sales volumes.

- The CCI for sales expectations decreased from 68.3 to 38.1 in February.

- The CCI for profit margin expectations decreased from 61.9 to 36.6.

- The CCI for staffing levels decreased from 69 to 45.2.

“In the course of a month, construction industry confidence has shifted from ecstatic to utterly dismayed,” ABC Chief Economist Anirban Basu says. “If anything, confidence is likely to decline further as construction industry leaders come to terms with the full extent of the COVID-19 crisis. The finances of key sources of demand for construction services, including commercial real estate investment trusts, state and local governments, retailers and hoteliers, have been savaged by the crisis, translating into fewer funds available to finance construction.

“Normally, construction activity is partially shielded from the initial stages of downturn due to the presence of backlog, which stood at 8.2 months as of February 2020. But this time is at least somewhat different, with certain construction activities halted in California, Pennsylvania, Massachusetts and elsewhere. While construction will hold up better in the near-term than retail, restaurants, airlines, auto manufacturing, lodging and a number of other key industries, its recovery is also likely to be less profound than in these other segments absent a federal infrastructure-oriented stimulus package.”

Latest from Construction & Demolition Recycling

- Radius to be acquired by Toyota subsidiary

- Pacific Steel selects Danieli as EAF equipment supplier

- Viably, Turmec partner on Ohio installation

- EPA plans to revisit numerous environmental, climate regulations

- Connecticut recycling facility looking to accept C&D faces local pushback

- Fornnax wins Green Innovation of the Year award

- ABC: Construction backlog inches lower, staffing levels expected to grow

- Former detention center in Cleveland set for demolition