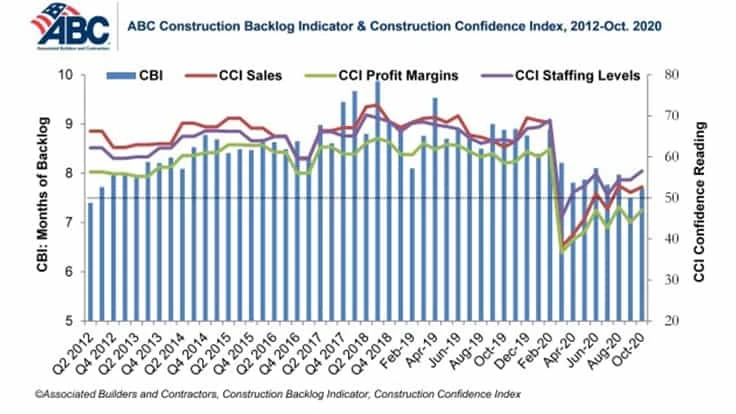

Associated Builders and Contractors (ABC) has reported that its Construction Backlog Indicator (CBI) rebounded to 7.7 months in October, an increase of 0.2 months from September’s reading, according to an ABC member survey conducted from Oct. 20 to Nov. 5. Backlog is 1.2 months lower than in October 2019.

Additionally, ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased in October. Sales and staffing index readings remained above the threshold of 50, indicating expectations of expansion over the next six months. For profit margins, this is the eighth consecutive month of decreasing readings.

Given political uncertainty, surging COVID-19 infections, a lack of additional stimulus, diminished state and local government tax revenues, and more, ABC Chief Economist Anirban Basu says nonresidential contractors remain surprisingly upbeat.

“Both sales and staffing levels are expected to climb over the next six months,” he says. “While profit margins are expected to slip, only 6 percent of contractors expect a large decline in margins. Backlog was down in October from the same time one year ago but up for the month, further indicating a level of industry stability that was not fully anticipated.”

While these remain treacherous times, nonresidential contractors can anticipate a better future, at least eventually, Basu says.

“Further stimulus seems likely, including additional monies for infrastructure. Large tax hikes now seem unlikely, helping to explain a surge in stock values despite incomplete information on election outcomes. Interest rates remain low, and the Federal Reserve remains accommodative. Moreover, most economists expect a significant rebound in economic activity in 2021, especially after winter’s end. That will set the stage for an eventual recovery in commercial construction spending.”

Latest from Construction & Demolition Recycling

- Radius to be acquired by Toyota subsidiary

- Pacific Steel selects Danieli as EAF equipment supplier

- Viably, Turmec partner on Ohio installation

- EPA plans to revisit numerous environmental, climate regulations

- Connecticut recycling facility looking to accept C&D faces local pushback

- Fornnax wins Green Innovation of the Year award

- ABC: Construction backlog inches lower, staffing levels expected to grow

- Former detention center in Cleveland set for demolition