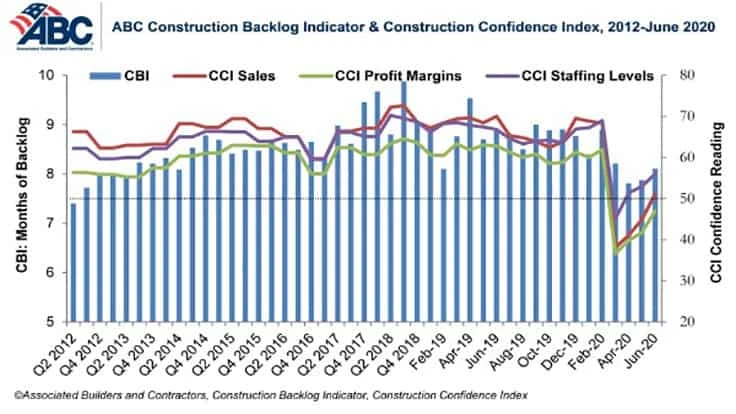

Associated Builders and Contractors (ABC) has reported that its Construction Backlog Indicator (CBI) rose to 8.1 months in June, an increase of 0.2 months from May’s reading. However, CBI is down approximately 8 percent from its June 2019 level.

“While backlog has been stable over the past two months, current readings may be hiding some latent weakness,” says ABC Chief Economist Anirban Basu. “Many contractors indicate that projects are being placed on hold. Some of this may be due to public health or jobsite-specific concerns, but tighter financial conditions also play a role. When projects are postponed, they remain embedded within contractor backlog, but near-term revenue suffers, and the probability of outright project cancellation rises.”

According to an ABC member survey conducted from June 20 to July 1, every region except the Middle States experienced an increase in backlog in June compared to May. Additionally, the survey indicates that confidence among U.S. construction industry leaders increased regarding staffing levels, profit margins and sales in June.

Construction sales and staffing levels are expected to expand over the next six months, while profit margins are expected to decline.

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels expectations all increased in June, although profit margin expectations remain below the threshold of 50, indicating ongoing expectations of contraction. More than 47 percent of contractors expect their sales to increase over the next six months compared to 39 percent who expect declining sales over that period.

- The CCI for sales expectations increased from 44.9 to 51.1 June.

- The CCI for profit margin expectations increased from 41.7 to 47.

- The CCI for staffing levels increased from 53 to 56.

Contractors are also reporting greater competition for projects, which Basu says is consistent with suppressed profit margins.

“Nearly two in five contractors expect profit margins to shrink over the next six months, with nearly 9 percent expecting a sharp hit to margins,” he says. “A year ago, fewer than 1 percent of contractors expected a sharp contraction in margins and a majority expected margins to keep rising. According to the latest survey, fewer than one in three contractors expect margins to rise over the next six months.”

Latest from Construction & Demolition Recycling

- Holcim spins off North American operations

- SmithCo adds director of manufacturing

- Superior Industries names aftermarket VP

- NDA's Demolition Convention & Expo honored for growth

- Trade shows partner on mental health awareness

- Cielo settles with contesting shareholder

- Evoquip adds trommel screen to product line

- Bomag to showcase innovations on the National Mall