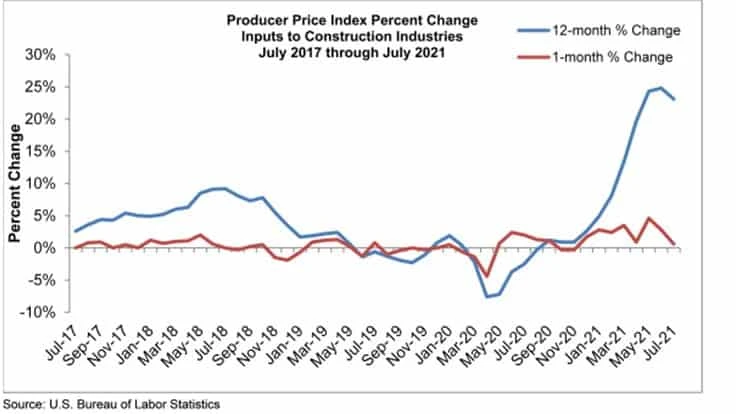

Construction input prices rose 0.6 percent in July, according to an Associated Builders and Contractors (ABC) analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices increased 0.8 percent for the month.

Construction input prices are 23.1 percent higher than a year ago, while nonresidential construction input prices increased 23.4 percent over that span.

Energy prices continue to experience substantial year-over-year price increases. The price of natural gas is up 146.7 percent, while crude petroleum and unprocessed energy materials prices are up 102.9 percent and 93.8 percent, respectively. Prices for steel mill products increased 10.8 percent for the month and are up 108.6 percent for the year.

“One’s definition of transitory needs to evolve with these data,” says ABC Chief Economist Anirban Basu. “While it is quite likely that there will be less inflation a year from now, a rebounding economy, ongoing supply chain disruptions and limited productive capacity have conspired to generate rapid price increases.

“Many economists insist that the current situation is merely temporary; still, today’s input price increases can meaningfully affect contractor fortunes by trimming margins and delaying the onset of projects.”

According to Basu, the good and bad news is that the economy is flush with liquidity.

“Injections of money supply by the Federal Reserve, which has yet to indicate when it will begin to moderate its quantitative easing program, have helped create large pools of investable money,” he says.

A significant fraction of that money is also being invested in real estate, which Basu says will often translates into construction projects. That is consistent with the stable-to-rising backlog observed in recent months as well as ongoing confidence among contractors, reflected in ABC’s Construction Backlog Indicator and Construction Confidence Index. However, Basu warns that liquidity also serves to help push prices higher.

“One can only conclude that the economy will continue to run hot into 2022 despite the malign impacts of the delta variant, producing both hefty advances in gross domestic product and unusually elevated inflation,” says Basu. “The fact that steel prices are rising is not only an indication of the recovery transpiring in goods-producing industries like construction and manufacturing, but also of the difficulty global suppliers are having keeping up with demand.

“That dynamic does not appear poised to change substantially in the very near-term, though there was some evidence of moderating inflation in the most recent Consumer Price Index report. Contractors should assiduously build contingencies into their contracts to protect themselves from additional materials price spikes. Given that construction firm services are in high demand, contractors should have enough negotiating leverage to accomplish that under most circumstances.”

Latest from Construction & Demolition Recycling

- Mazza Recycling adds to transfer station operations

- Michigan awards $5.6M in recycling, waste reduction grants

- Pittsburgh area mall headed for demolition

- RMDAS figures show February surge in recycled steel’s value

- US economic indicators show signs of wavering

- Northstar signs asphalt shingle supply agreement with York1

- Metso’s Lokotrack line turns 40

- Takeuchi adds dealer in Mississippi